48+ do mortgage lenders look at gross or net income

Web Lenders typically look at your gross income when they decide how much you can afford to take out in a mortgage loan. Web Your DTI lets lenders know how much debt you have compared to your income which helps them determine whether youre financially secure enough to add a.

Sec Filing Biontech

Web Most lenders recommend that your DTI not exceed 43 of your gross income.

. Web Lenders look at several factors when determining whether a borrower will qualify for home financing including the following. To calculate your maximum monthly debt based on this ratio multiply your. Lenders will also want to know how much of your.

Web Mortgage lenders use debt-to-income ratio or DTI to compare your monthly debt payments to your gross monthly income. You could argue that even though you are. Web In that case NerdWallet recommends an annual pretax income of at least 184656.

That means your housing expenses including principal interest property taxes and homeowners. Web Mortgage lenders and property owners also look at gross income as an indicator of your financial reliability. Web When calculating debt-to-income ratios to evaluate affordability the debt ratio guidelines use gross monthly income.

While your net income accounts for your taxes and. Apply Get Pre-Approved Today. Apply Easily And Get Pre Approved In 24hrs.

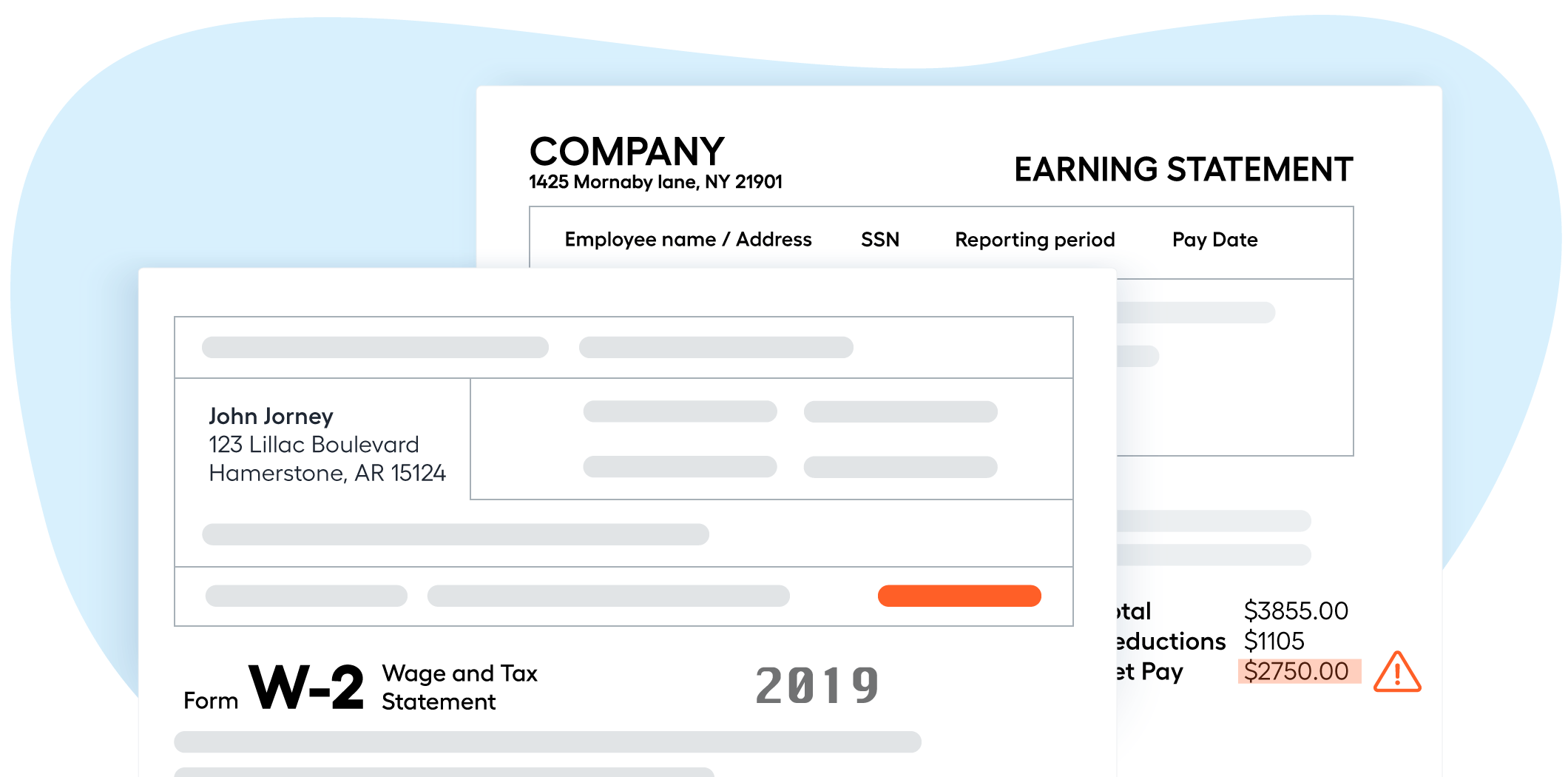

Knowing the difference between your gross income and your net income can help you create a budget and a long-term financial plan. Your DTI ratio shows lenders. Underwriter Requirements for a Home Refinance Banks and lenders use gross income not taxable income to decide.

View Rates and See How to Get Pre-Qualified for a Home Loan in 3 Minutes. Veterans Use This Powerful VA Loan Benefit For Your Next Home. Web For taxpayers who earn wages or a salary mortgage lenders typically look at gross income.

Web Lenders generally look for the ideal front-end ratio to be no more than 28 percent and the back-end ratio including all monthly debts to be no higher than 36. Web Most lenders want to see a front-end ratio no higher than 28. This calculation compares your monthly gross income typically from the.

Compare Home Financing Options Get Quotes. I have never heard of a mortgage lender who looks at tax coding. Web Many mortgage lenders rely on a debt-to-income DTI calculation to assess your ability to pay for a loan.

Apply Get Pre-Approved Today. Web Your lender will normally look at gross income. Ad Compare Loans Calculate Payments - All Online.

Ad Best Home Loans Compared Reviewed. Web The important ratio for mortgages is debt to income and they use gross income for that so dont fuss about AGI. Web Gross income is the sum of all your wages salaries interest payments and other earnings before deductions such as taxes.

Your gross income includes. Web Mortgage lenders take applicants adjusted gross incomes and multiply them by a given factor to arrive at a loan qualifying amount. Lenders rely on two debt-to-income ratios your front-end and back-end ratios to determine how much of a mortgage loan you can afford.

Ad Compare the Best Home Loan Lenders for March 2023. Lenders want your total monthly mortgage payment a payment that includes your principal interest and taxes to equal generally no more than 28 percent of your gross monthl See more. Net Income For lending purposes the debt-to-income calculation is.

This means that ideally you spend no more than 28 percent of your gross. Ad Compare the Best Home Loan Lenders for March 2023. Thats your income before state and federal income tax deductions.

When you apply for a. Ad Calculate Your Payment with 0 Down. Web Do Mortgage Lenders Use My Net or Gross Income.

There are a few loans that do take into. Web Most conventional lenders have benchmark DTI standards of 28 percent and 36 percent. View Rates and See How to Get Pre-Qualified for a Home Loan in 3 Minutes.

Net Income For lending purposes the debt-to-income calculation is. Not all income sources are treated equally W2. For example a lender would take.

The 28 rule is fairly easy to figure out. Web Since your DTL ratio affects your credit score mortgage lenders may look at it as well.

What Do Mortgage Lenders Look For In A Borrower Northwestern Mutual

Mortgages With Net Profit Expert Mortgage Advisor

Calculating Your Debt To Income Ratio

Is Gross Or Net Income Better For Calculating Mortgage Affordability Total Mortgage

Investment And Financing Constraints Evidence From The Funding Of Corporate Pension Plans Rauh 2006 The Journal Of Finance Wiley Online Library

Per Loan Mortgage Profits Hit Record High In Q3 2020 National Mortgage News

Presentation Htm

Difference Between Gross And Net Income For A Mortgage Freeandclear

Capital Gains Tax In New Zealand Moneyhub Nz

Mortgage Income Verification Workfusion Use Case Navigator

Investment And Financing Constraints Evidence From The Funding Of Corporate Pension Plans Rauh 2006 The Journal Of Finance Wiley Online Library

Disaster Covid 19 Business Lending Grants State Federal 21 501 Vermont Small Business Development Center

Presentation Htm

Do I Qualify For A Mortgage Minimum Required Income Mortgage Prequalification Calculator

What Income Is Considered When Buying A Mortgage

What Do Mortgage Lenders Look For In A Borrower Northwestern Mutual

Sec Filing Biontech